02 Feb Regulation from OTC Derivatives Industry FRM Part 2 Research Cards

The typical investor would be to come across that which you they require on the common exchanges for example Binance or Coinbase, but for huge investors trading more than-the-avoid is practical. Modern-go out laws tend to prefer the fresh rich (anyone and you will organizations) since the just the rich avax swap find the money for checklist to your specific transfers. As well as, sometimes, just buyers with a high net worth (so-titled “accredited”) can buy other businesses/ideas. Cryptocurrency try an excellent grassroots course built to top the new playing field. Still, we’ll give certain alternatives for the fresh thus-called “little seafood” from the pursuing the part.

It stands for the cornerstone nowadays’s monetary remittance system and removes way too many transactions that you can get that have main cleaning. Often OTC brokers can get a profit alternative – both for selling and buying Bitcoin. It’s crucial that you consider to own large quantities of money, KYC subscription becomes necessary. Bitcoin OTC brokers gamble a very important character in the China due to help you a federal government exclude to your cryptocurrency exchanges. Inside the China, it’s no more court to run a good cryptocurrency change on account of a legislation change in 2017. It’s got kept high Chinese exchanges and you may OTC desks including OKex, Binance, Genesis Block and you may Huobi functioning overseas or because the OTC brokers.

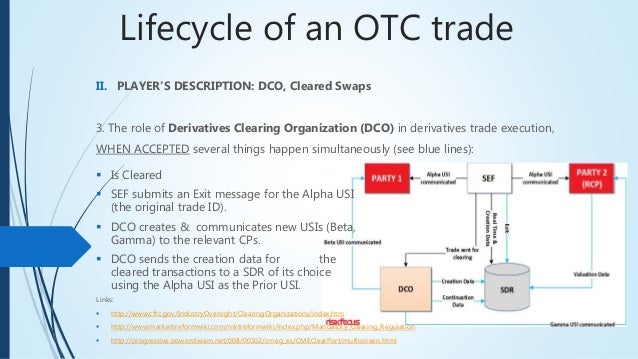

Inside the economic areas, cleaning is necessary to support the transactions, including, guaranteeing suppliers away from a secured asset found their funds and buyers score its asset. Bilateral cleaning creates a soft and you may successful marketplaces, quicker purchases, and lower purchase can cost you. As well as bringing types of two-sided clearing, we’ll as well as highlight the essential difference between bilateral cleaning compared to. main cleaning.

Over-the-restrict (OTC) try entities that enable the fresh trade of large quantities out of Bitcoin and other cryptocurrencies. OTCs render a lot more personal and you may custom characteristics in order to associations and you can highest net-well worth those who you would like a leading standard of exchangeability and you can confidentiality. The key benefit to an OTC is because they manage large trade volumes, for example trade one hundred,000+ USD instead price slippage. OTC buyers will generally offer an attack rate for the entire buy block having instant execution.

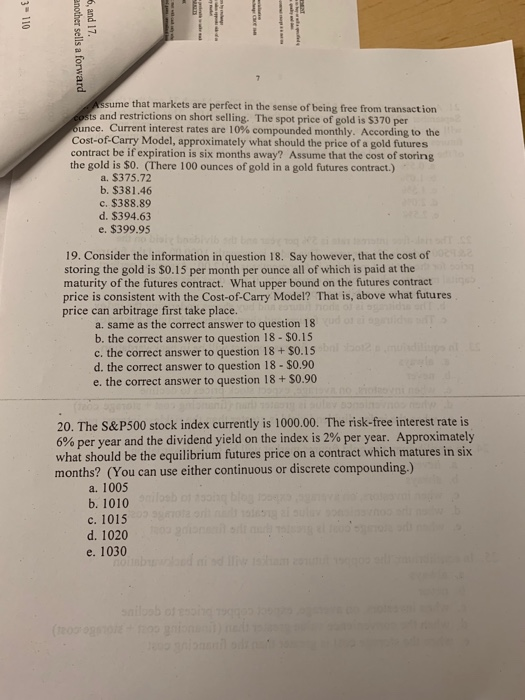

As you can see of lower than, costs are different significantly down seriously to additional likewise have and you will demand pushes. You might request a bid from the personal consumer exchange table and also safe an expense after you finance your bank account. Satstreet is facilitate bitcoin investments between twenty-five,000 – a hundred,100000 to own customers in the usa and you can Canada. B2C2 allows you to buy and sell sets from smaller amounts to over million-dollar bitcoin prevents.

Big participants looking to buy otherwise offer vast amounts out of cryptocurrencies are better of playing with an OTC representative. This is because a single exchange (no matter what higher) will not have the fresh exchangeability must fill high acquisition blocks. Research has shown one offer requests away from US30 million is also significantly inhibits the expense of a good cryptocurrency, and this leading to slippages of 5-10percent. Another advantage of having fun with OTCs is because they could possibly offer to help you secure a certain quotation to your choice to settle at another time. This provides anyone a lot more independence to maneuver funds from financial institutions or cold-shop (including the Ledger Nano X).

Banking companies will be required to hang liquid assets that will be adequate to meet one margin phone calls (with becoming fulfilled quickly). The few deals which can be exempted from the lingering reforms were nonstandard deals, find foreign exchange purchases, and you can deals associated with low-monetary organizations. Cleaning is the procedure by which derivative deals accept, that’s, a proper and you will prompt transfer out of money between your buyer and you may the vendor. Stocks traded in the a keen OTC business you may fall under a little organization you to’s yet to meet the newest standards to own listing on the replace. Kelly Partners Category Holdings Ltd. begins exchange now to your OTCQX under the icon “KPGHF.” U.S. investors are able to find latest financial disclosure and you may Actual-Day Height 2 quotes for the team to the OTCQX really does maybe not checklist the newest carries one to sell for less than four bucks, called penny brings, layer organizations, or companies going through bankruptcy.

Holds you to trading for the transfers have been called indexed carries, whereas brings one to change thru OTC are known as unlisted stocks. Over-the-restrict (OTC) is the process of change bonds thru an agent-dealer community unlike to the a central replace such as the Nyc Stock-exchange. Two-sided clearing anywhere between two events which faith one another reduces exchange times and you will will cost you, undertaking an efficient flow from funding.

- This consists of the newest transformation of fifty+ outside businesses, as well as the discharge of 20+ greenfield enterprises.

- In the event of a default otherwise case of bankruptcy, derivatives purchases are handled in a different way from other deals.

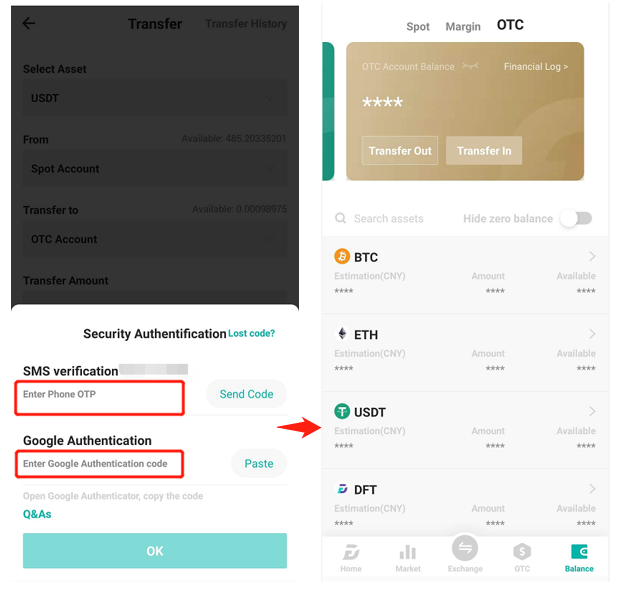

- For this reason, brokers require customers to do an identification verification techniques labeled as KYC (Discover Your Customers), which helps end identity theft, currency laundering, or other sort of con.

- OTC trading, in addition to exchange trade, happens which have products, monetary instruments (along with carries), and you may types of these things.

Inside the an enthusiastic OTC market, it’s easy for a couple players to replace points/securities in person rather than someone else knowing the brand new words, such as the price. The newest OTC marketplace is a choice to own quick organizations or those people that do not need so you can list otherwise never number on the standard exchanges. Number on the an elementary change are a costly and day-consuming procedure and outside of the economic capabilities of numerous smaller businesses.

Because of the insufficient control and you can visibility, manipulation of your electricity marketplace is an intrinsic chance of OTC change. Because of the instantly linking electricity exchange cost which have OTC trade networks, strength people is also influence the new change rates because of directed sales and you may yield highest OTC trade profits. People and you will sellers on the a lot of time-name futures industry are seeking an informed rate for sure quantities of strength in the an exact months, regardless of cost for the unpredictable location areas. This plan, also known as hedging, obtains OTC location field deals with a significantly shorter time, leading them to relatively riskier.

Moreover, the lack of transparency and you can weakened exchangeability relative to the new official transfers is also result in devastating situations through the a financial crisis. The greater amount of difficult type of the brand new ties causes it to be more difficult in order to influence its fair worth. Hence, the possibility of conjecture and you will unanticipated incidents is also hurt the stability of your segments. Over-the-stop (OTC) try trade bonds thru a brokerage-agent network as opposed to for the a centralized change for instance the New york Stock market. Even if OTC sites aren’t official transfers, they have qualification conditions dependent on the brand new SEC.

Bitcoin OTC Agents: What are It, How can It works, And really should You utilize Her or him | avax swap

To begin to your Satstreet, you have got to sign up for your own or business savings account. Depending on the sort of membership, you will have to provide KYC and you will conformity info. After you have submitted the appropriate analysis, the platform will take up to twenty-four time to set up your account. While you can also be trading any amount you would like, if you transact more than ten,one hundred thousand USD otherwise EUR monthly, you may enjoy an additional list of services for example personalized communications options and you may 24/7 to your-phone call services.

Less than is an intensive set of advantages and disadvantages of these traders considering a keen OTC Bitcoin Representative. CoinCentral’s citizens, writers, and/or invitees article writers might not have a good vested interest in some of the above ideas and you can organizations. None of your own blogs to your CoinCentral is actually funding information nor is it an alternative for guidance out of an official monetary coordinator. To fully eliminate the middleman, its party has adopted exciting cryptocurrency tech named atomic swaps. Trading can help you thru MetaMask otherwise directly from the very safe Ledger Nano S otherwise Trezor equipment purse. Samples of OTC derivatives were forwards, exchanges, and you will exotic alternatives, as well as others.

- Satstreet relies on community-leading APIs, with smart order navigation, and you may uses local financial institutions for pretty much immediate agreements.

- The new file lets an investor for taking advantageous asset of products and characteristics offered by multiple brokers just before cleaning all the deals with their broker at the conclusion of the day.

- Which part lines the new acceptable forms of security, the brand new security that needs to be published because of the either side (if any), and now have haircuts that could be applied.

- All security required will have to be in form of cash otherwise treasury devices to enhance exchangeability.

- More resources for the way we manage better-informed and productive segments, go to

PwC refers to the You affiliate corporation or among their subsidiaries otherwise associates, and could both consider the brand new PwC system. This content is for general guidance objectives just, and cannot be taken as a substitute to possess session having elite group advisors. To learn more about the way we do better informed and much more effective locations, check out the carrying organization, Kelly Couples Class Holdings Restricted, is noted on ASX on the 21 Summer 2017. The newest OTCQB is usually known as “venture business” which have an attention of making businesses that must report its financials for the SEC and you will submit to certain supervision.

Knowledge Bilateral OTC Types

When searching for the best Bitcoin OTC Broker, it’s crucial that you discover a firm who may have a reputable system. Doing this have a tendency to increase the probability of finding the right customer otherwise supplier for type of exchange. One thing to know about bitcoin brokers is they aren’t monetary advisors.

What is the OTC Market?

Traditionally on the stock exchange globe, OTC tables facilitate trading away from securities which are not listed on formal transfers, age.g. the newest York Stock exchange. Consumers and vendors promote due to their bitcoin agents, which helps him or her are still anonymous from the transaction. The majority of OTC transactions cover large sums of cash because the OTC bitcoin agents help rich people end “slippage”. It’s probably a good idea to tune in to rates detailed to the a good cryptocurrency replace for example Binance to get an excellent ballpark when and make a trade.

Over-the-Restrict Derivative

The platform is designed for organization traders for example hedge finance, percentage organization, crypto miners, proprietary traders, and. FalconX have a diverse party having finance and technology experiences and you can has offices in the us and you can China. OTC bitcoin brokers power a system out of counterparties (consumers and you can sellers) to perform positions and meet their clients’ trade demands. In the an excellent main cleaning, the entire procedure is actually managed by the a main counterparty that provide features like those people given by a fully-fledged replace clearinghouse.

To protect yourself away from such as interest, always are exchange that have legitimate brokers that have proper KYC. Moreover, never purchase “discounted” Bitcoins offered on the social media such as Instagram otherwise Fb. Cumberland try a great Chicago-centered crypto company which provides OTC bitcoin exchange in order to buyers and you may establishments to help you exploit the new possibilities. Revealed inside 2014 while the a good subsidiary of DRW, a many years-old diversified change firm, Cumberland now offers an alternative exchange experience with twenty-four/7 entry to buyers agencies. Additionally, Cumberland allows counterparties access its electronic package, that gives real-day, online streaming, as well as 2-way rates, as well as its API.

Inside OTC change, trade couples have been in lead get in touch with collectively otherwise incorporate an agent. The new transactions themselves occur to the trade programs on line or due to brokerage organizations. Agreements to your change volumes and you may rates is achieved personally and you can bilaterally one of the functions, but contractual conditions to own simplification and you will exposure minimization is actually putting on acceptance. OTC trade is a very common routine from the opportunity business, representing the largest quantity of power business purchases in lot of regions. Conventionally-sourced strength is far more popular for OTC deals than simply renewably-sourced energy. One of the many is counterparty risk – the possibility of one other group’s default before the pleasure or expiration from an agreement.

Jump Trade offers better-degree computational potential you to publication analysis investigation of OTC crypto positions. Jump will act as a principal change mate handling multiple counterparties with their digital trading program or its awesome streaming API. Crypto Dive, a department in the Dive Trading, inside the delivering liquidity and you can technology possibilities in order to nascent crypto plans and you will programs. Bitcoin Set-aside try a keen Estonian-founded more-the-stop (OTC) exchange services enabling one pick bitcoin (BTC) or bitcoin-relevant possessions value more ten,100000 USD Or EUR. The fresh bitcoin trading provider is actually based within the 2018 by the a team of global broker benefits giving a customized OTC trading feel to help you bitcoin fans.

According to where derivatives trading, they are categorized as the more-the-avoid otherwise replace-replaced (listed). In contrast to trade to the official exchanges, over-the-stop change does not require the new exchange away from just standardized points (age.g., obviously discussed directory of amounts and you may top-notch items). OTC deals try bilateral, and every people you will face borrowing from the bank chance questions out of their counterparty. Over-the-avoid (OTC) ‘s the trade out of bonds ranging from two counterparties conducted outside formal transfers and you will without the supervision away from an exchange regulator. OTC trading is carried out within the over-the-prevent segments (a good decentralized place with no bodily place), thanks to specialist networks.

The new correspondence channels popular were phone, email address, and you will computers. OTC exchange is actually facilitated from the a good derivatives agent just who constantly is actually a primary lender specializing in types. Over-the-stop segments do not have actual cities; instead, trade is carried out electronically. Otcmkts, or OTC locations (over-the-avoid locations), is actually areas where bonds trade which are not listed on major transfers from the U.S. OTC securities trading instead because of an agent-specialist community tend to because they do not meet the requirements out of the top transfers. In the united states, over-the-restrict exchange of stocks is completed due to systems away from field suppliers.

OTC practices is going to be possibly regionally discovered, serving local customers or global. Have a tendency to biggest cities including Hong-kong, Tokyo otherwise Ny provides OTC brokers repair regional subscribers. These types of brokers provide extremely individualized services as well as individually meetups.

Have fun with some common feel if you intend to trade in actual goods and/or currency. Your obtained’t has difficulty buying or selling Bitcoin however in the modern ICO boom, you’ll most likely has issues exchange altcoins having reduced exchangeability. Ethereum features quick-tracked cryptocurrency production possesses therefore never been easier to create what exactly is amusingly known as the “shitcoin”. The first vent of call is to monitor replace feeds to find a sense of exactly how prices are trading. You could then pick up some crypto cheap on the an exchange or among the procedures already mentioned.

Best 7 OTC Bitcoin Agents You need to use within the 2023

The brand new OTC business has a distinct segment target one to targets buyers that have extreme sums of money who choose their sales getting filled from the one party. The brand new persons trying to a trade tend to offer prices on their broker, and it also’s the job of your own OTC agent to get in touch the consumer which have some other individual to complete the transaction. Examine which having exchanges and that checklist the brand new trading rate and you can leave you a getting for what just be paying for their cryptocurrency. Additionally, LocalBitcoins brings an escrow services so you can trading which have comfort away from mind.

As you can tell, the main city circulates to the Bitcoin features much outpaced any other cryptocurrency. From the strictest sense of the word, OTC form you can trade-in a completely discover opportunities. Indeed, you could potentially offer x quantity of Ethereum to have y number of Bitcoin rather than getting anywhere close to to the present rate (ETHBTC) entirely on any major exchange. Nothing is stopping you against exchanging cryptocurrency myself to your neighbor. A lot of people don’t understand otherwise fool around with crypto similar to this because’s not instantly necessary. However in metropolitan areas including Venezuela and you will Zimbabwe investing cryptocurrency over-the-restrict is/was applied to store short economies going considering the Government destroying its cost savings having hyperinflated report money.

Both well-identified systems is addressed by the OTC Locations Group plus the Monetary Community Controls Authority (FINRA). These communities offer offer characteristics so you can performing market traders. A clearing associate trade arrangement traces the connection anywhere between a trader and you may a brokerage.

Sorry, the comment form is closed at this time.